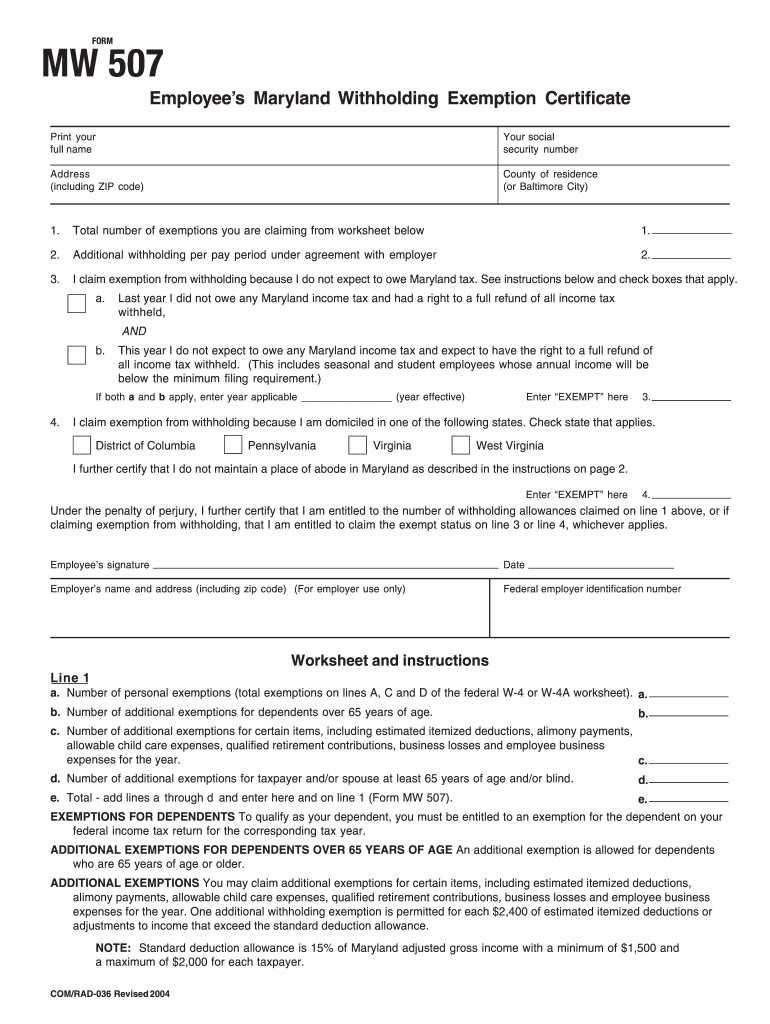

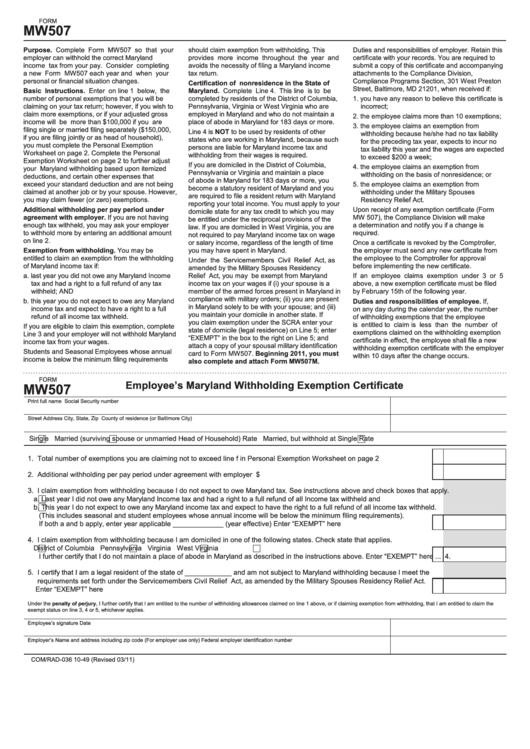

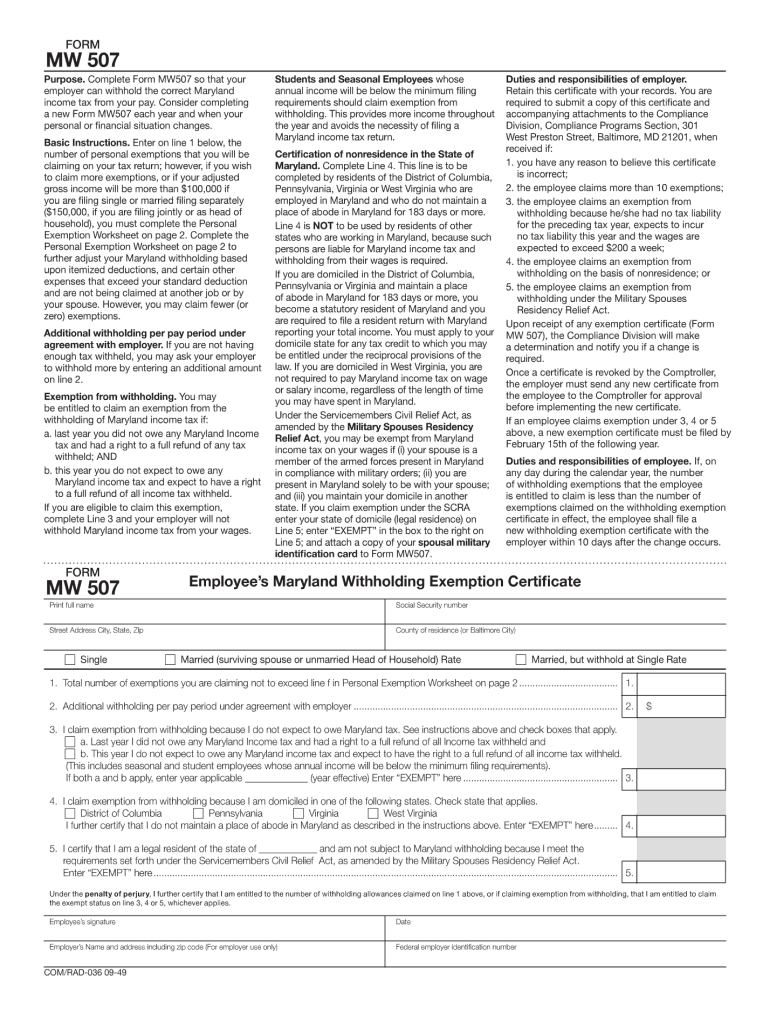

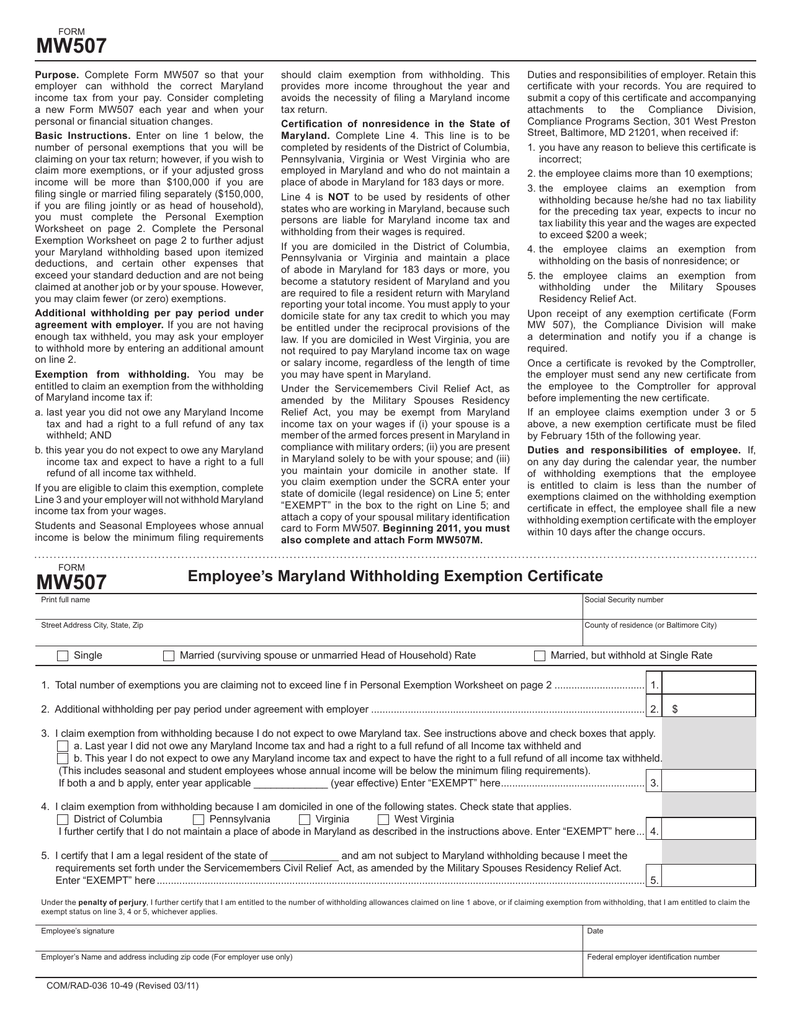

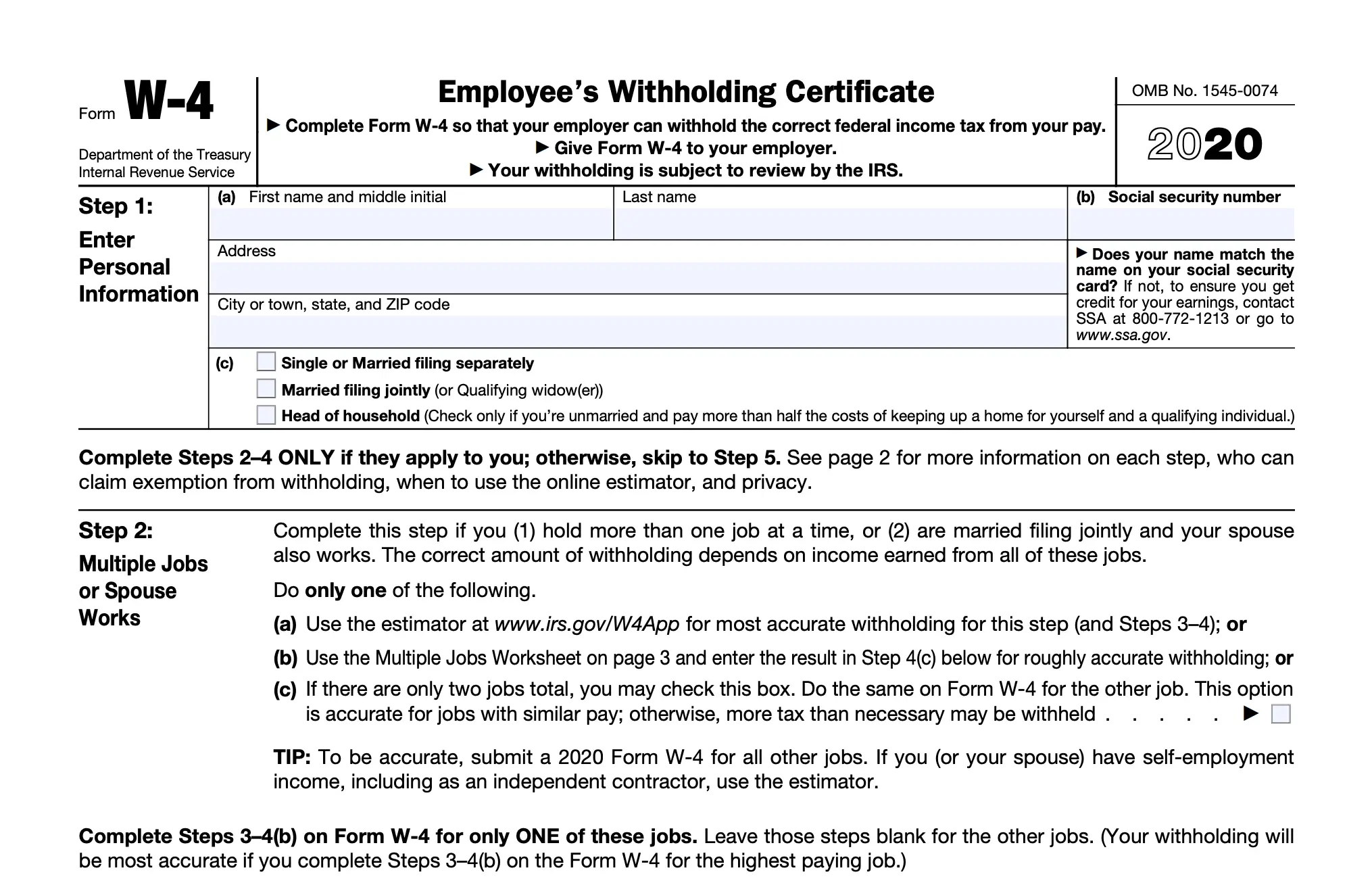

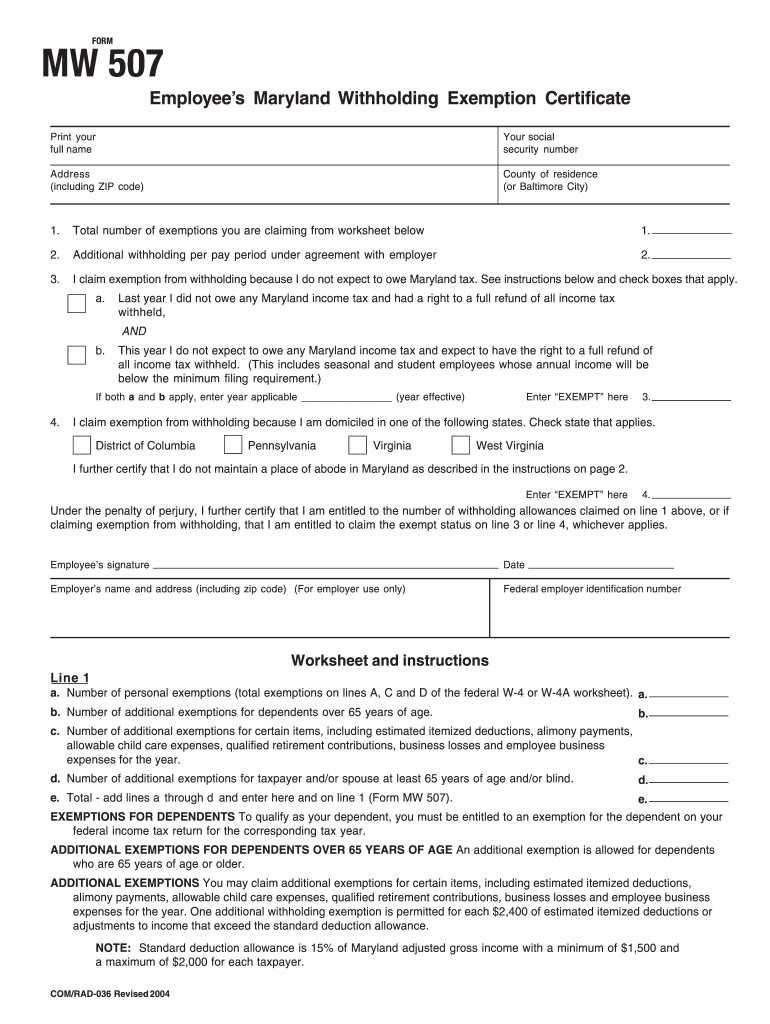

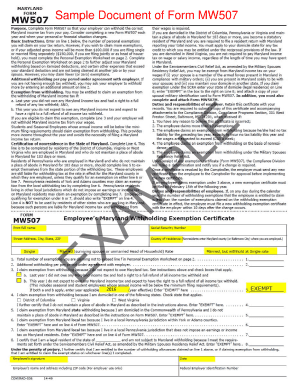

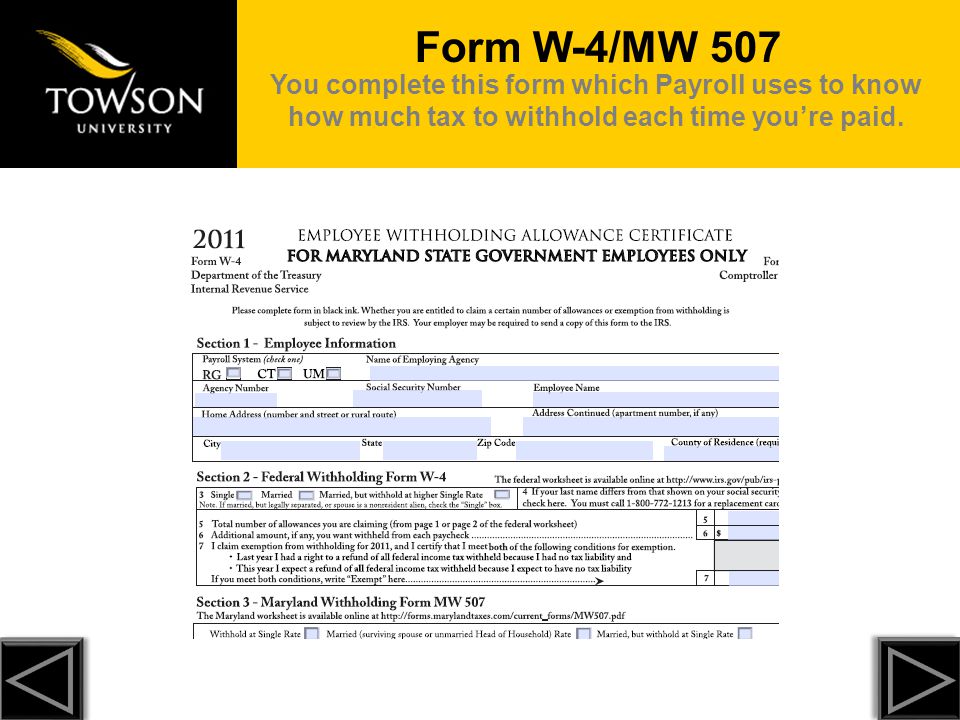

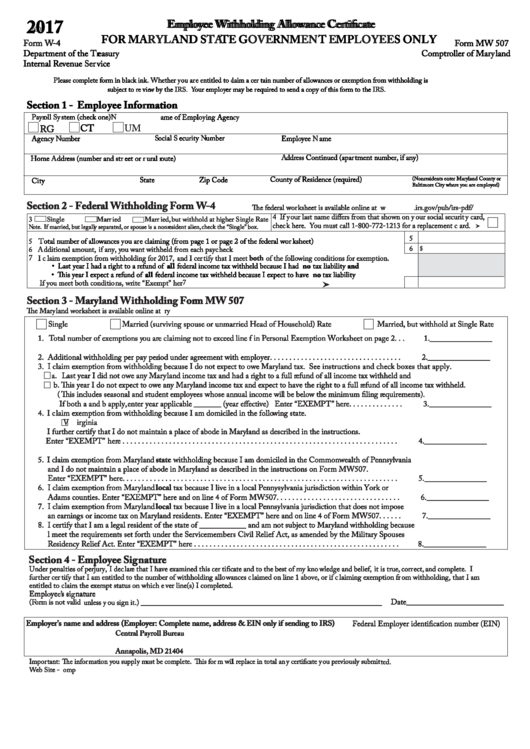

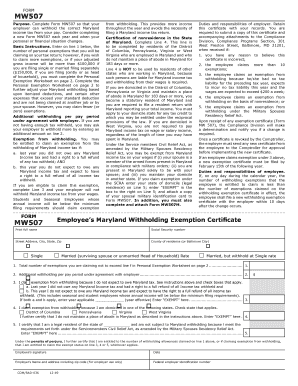

Form W4/MW 507 TU pays every 2 weeks (biweekly) Example A student worker who is single and wrote "1" on line 3 on the W4/MW 507, makes $ in a pay period This earned incomes falls in the $115$1 bracket In the "1" column of the chart below, it says that $9 tax is to be withheld Therefore, a paycheck for about $ ($ $9) will be issuedMW 507), the Compliance Division will make a determination and notify you if a change is required Once a certificate is revoked by the Comptroller, the employer must send any new certificate from the employee to the Comptroller for approval before implementing the new certificate If an employee claims exemption under 3, 4 or 5Form MW 507 Comptroller of Maryland 19 Form W4 Department of the Treasury Internal Revenue Service Section 1 Employee Information am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on which ever line(s) I completed (This

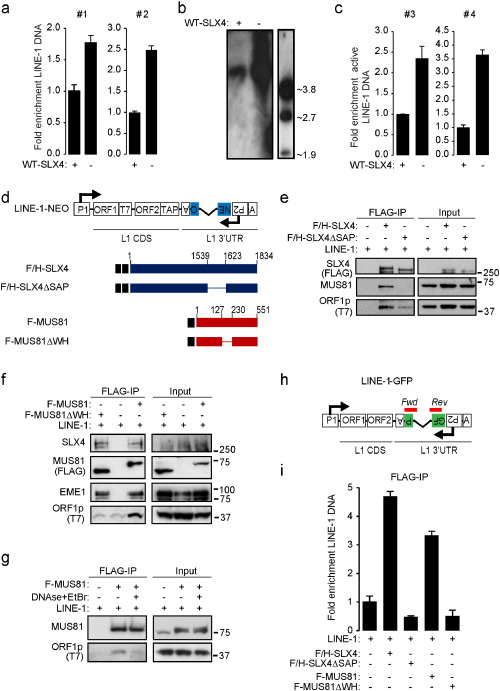

Line 1 Evasion Of Epigenetic Repression In Humans Sciencedirect

Mw 507 line 1

Mw 507 line 1-Jan 08, · Hi,I am currently updating my state withholding form in Maryland "Form MW507" and not sure how many exemptions to claim in Line 1 I am married, the head of household and my wife does not have a job read moreInstructions for the Maryland Withholding Form MW 507 Step 1 Personal Information • Check appropriate marital status box • Line 1 Enter the total number of allowances you are claiming • Line 2 Enter any additional dollars to be withheld from each paycheck, if wanted OR • Line 3

04 Form Md Comptroller Mw 507 Fill Online Printable Fillable Blank Pdffiller

Md Form 1 19 ;E Total add lines A through D and enter here and on line 1 (Form MW 507) EXEMPTIONS FOR DEPENDENTS To qualify as your dependent, you must be entitled to an exemption for the dependent on yourMd Form 11 ;

However, if your federal adjusted gross income is expected to be over $100,000, theForm MW 507orm MW 507 to the number of withholding alltify that I am entitled to the number of withholding allowances wances claimed on line 1 ablaimed on line 1 above, or if or if claiming exemption frlaiming exemption from withholdinom withholding, that I am that I amHowever, if you wish to claim moreexemptions, or if your adjusted gross income will be more than $100,000, you must complete the worksheet below, if you are filing singleor married filing separately ($150,000, if you are filing jointly or as head of household)

, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on whichever line(s) I completed 4 I claim exemption from withholding because I am domiciled in the following state VirginiaWell come To Mr Sk Youtube Channel Family This Chanel Please Subscribe And Press The Bell Botton First Of All Update News ᱥᱟᱜᱩᱱ ᱫᱟᱨᱟMW 507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions that you will be

A Raman Spectra For Acc 507 Activated Carbon Electrode Operating Download Scientific Diagram

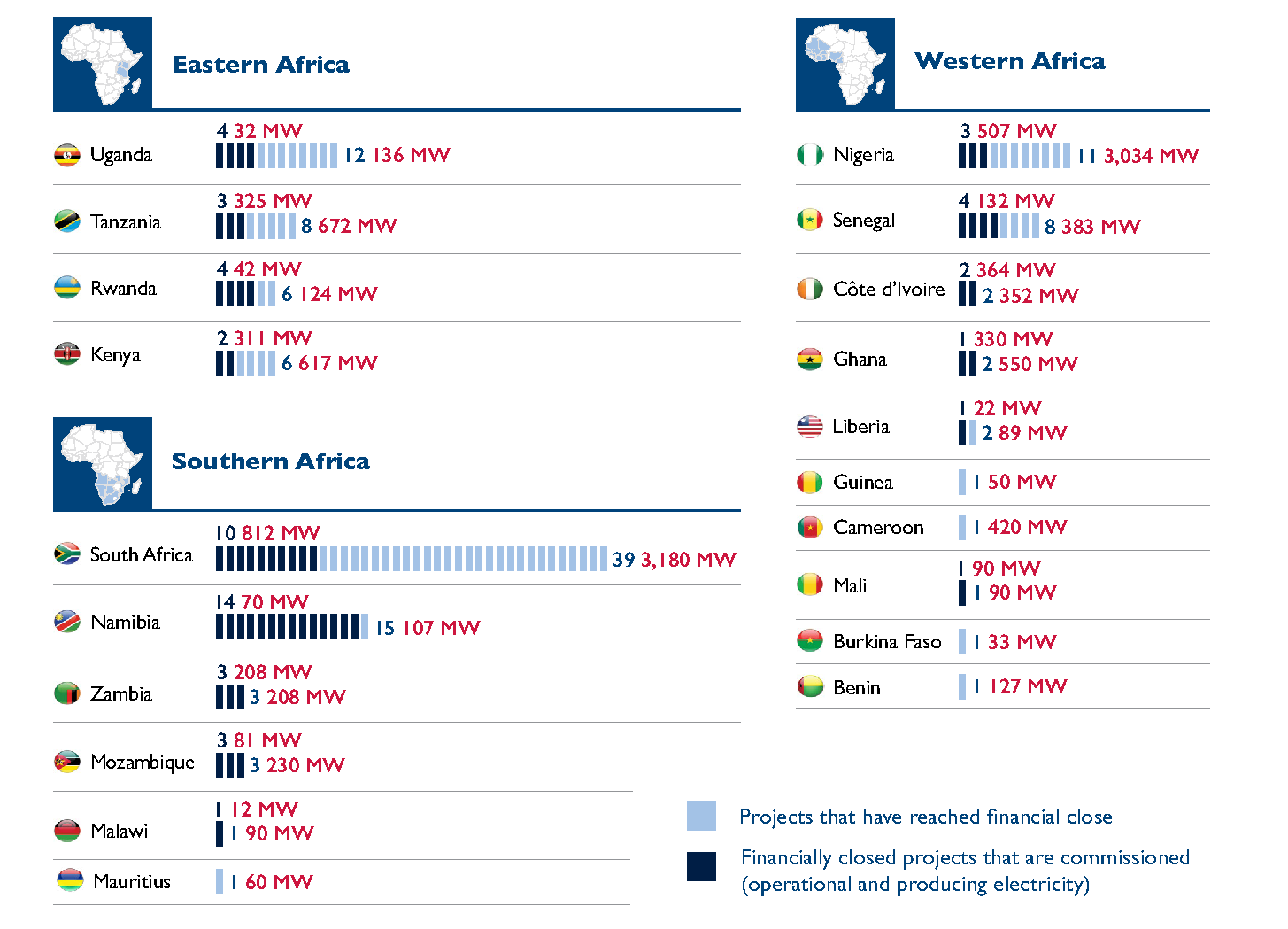

Seven Deadly Challenges Of Investing In African Energy Infrastructure And What Power Africa Is Doing About It By Andrew Herscowitz Medium

A sample of adenosine triphosphate (ATP) (MW 507, ε =14,700 M1 cm1 at 257 nm) is dissolved in 25 mLof buffer A 250 microliter aliquot is removed and placed in a 1cm cuvette with sufficient buffer to give a total volume of mL The absorbance of the sample at 257 nm is 115 Calculate the weight of ATP in the original 25 mL sampleMW 507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions you will claim on your tax returnMw507 Fillable Forms 09 ;

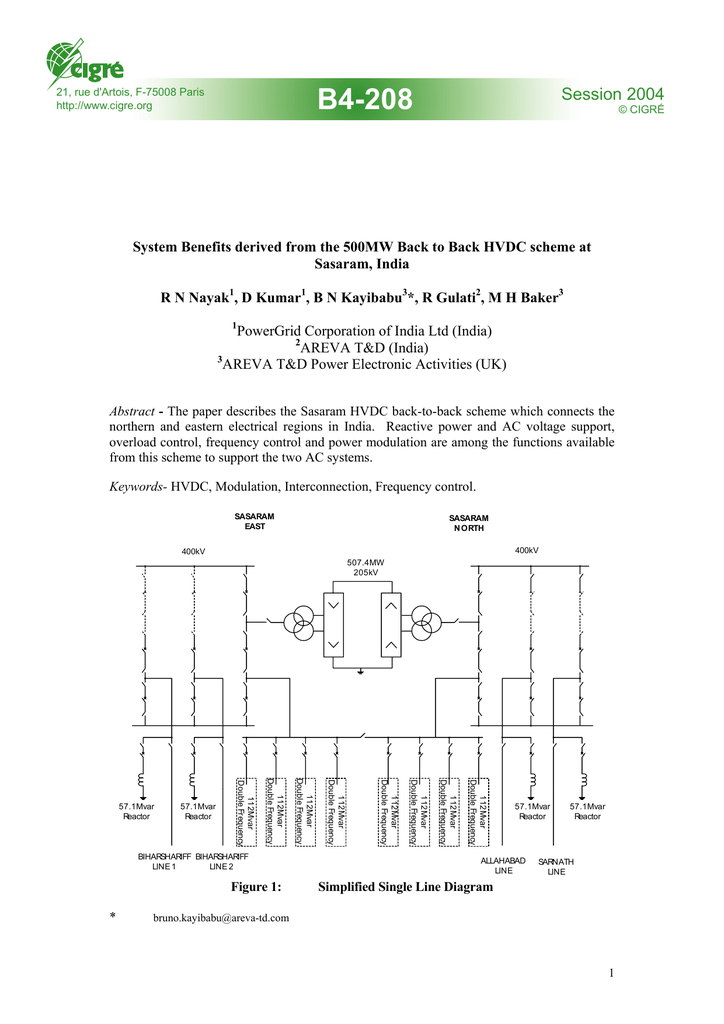

System Benefits Derived From The 500 Mw Back To Back Hvdc

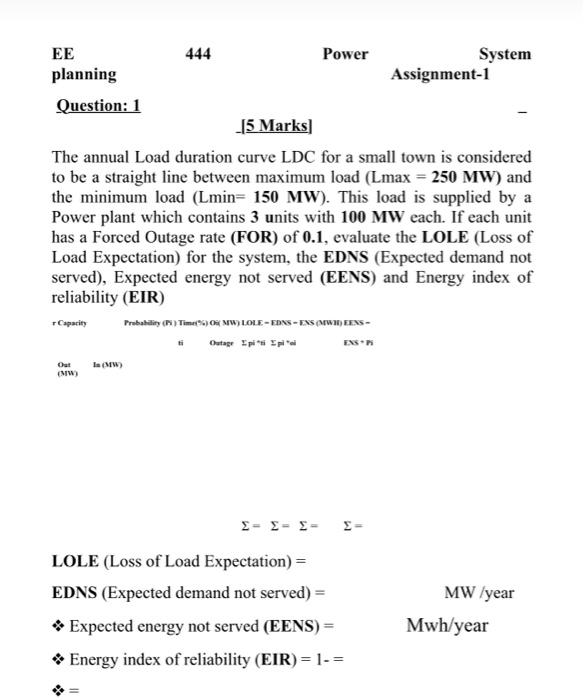

Ee 444 Power System Planning Assignment 1 Question Chegg Com

Enter on line 1 above, the number of personal exemptions that you will be claiming on your tax return;A sample of adenosine triphosphate (ATP) (MW 507, ε = 14,700 M −1 cm −1 at 257 nm) is dissolved in 50 mL of buffer A 250μL aliquot is removed and placed in a 1 cm cuvette with sufficient buffer to give a total volume of mLThe absorbance of the sample at 257 nm is 115 Calculate the weight of ATP in the original 50 mL sampleMW 507 PAGE 2 Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;

Ny Finance Briefing

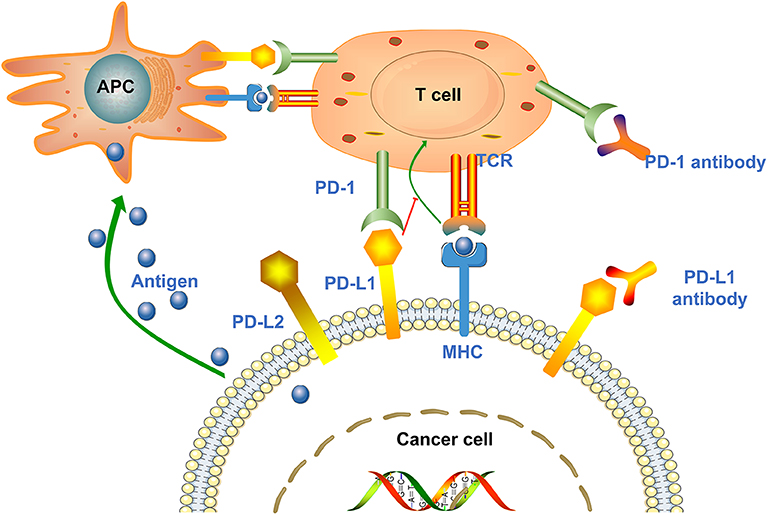

Frontiers Adverse Effects Of Anti Pd 1 Pd L1 Therapy In Non Small Cell Lung Cancer Oncology

Enter on line 1 below, the number of personal exemptions you will claim on your tax return However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are ling single or married ling separately ($150,000, if youMW 507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic InstructionsEnter on line 1 below, the number of personal exemptions that you will beHowever, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced Do not claim any

Pirtobrutinib In Relapsed Or Refractory B Cell Malignancies Bruin A Phase 1 2 Study The Lancet

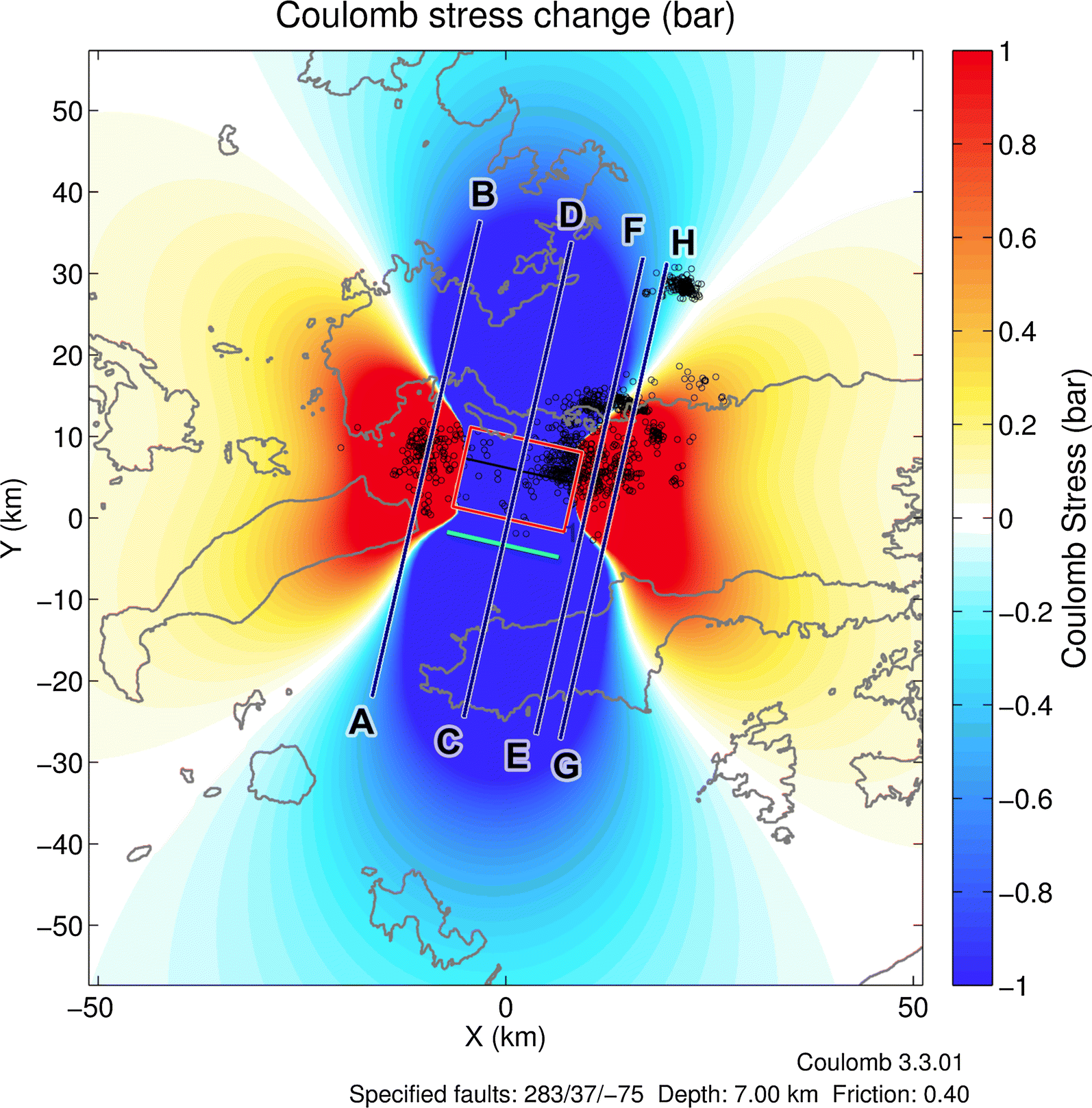

Figure 13 The July 17 M6 6 Kos Earthquake Seismic And Geodetic Evidence For An Active North Dipping Normal Fault At The Western End Of The Gulf Of Gokova Se Aegean Sea Springerlink

Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;2 Fill in Part 2;MARYLAND FORM MWS07 Purpo~ Complot Form HW507 so !hot )'

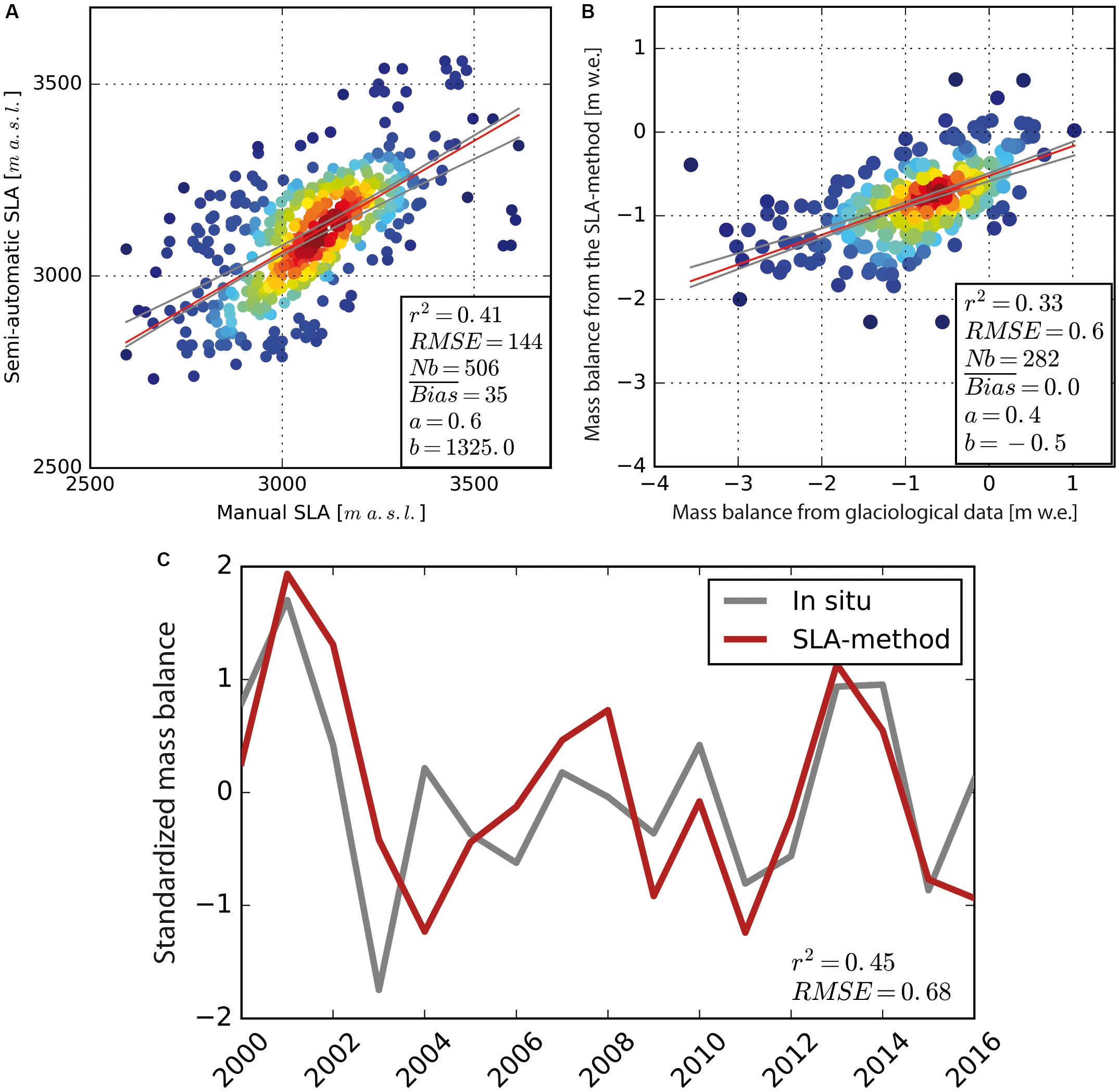

Frontiers Region Wide Annual Glacier Surface Mass Balance For The European Alps From 00 To 16 Earth Science

Osa Absolute Frequency And Isotope Shift Measurements Of Mercury 1s0 3p1 Transition

However, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reducedIf you checked "NO" to any of the statements in item 1, do not continue because you do not qualify for exemption from Maryland withholding tax for a qualified civilian spouse of a US Armed Forces Servicemember You must correct your Form MW507 filing if you had entered EXEMPT on line 8 of that form 3 I declare, under penalties ofForm Mw 507 19 ;

Show A 1 Line Message On Maker Screen Let S Start Coding Coding For Kids

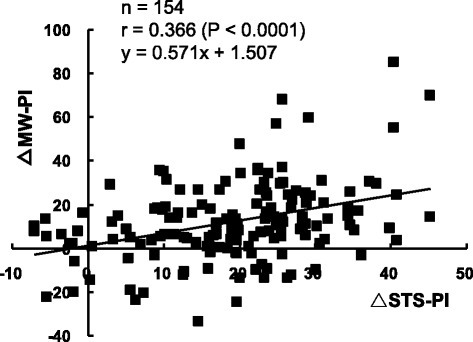

Relationship Between The Changes Of Sts Pi And Mw Pi At Open I

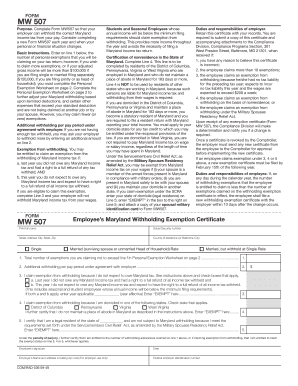

Apr 15, 09 · Employee's Maryland Withholding Exemption Certificate 1 FORM MW 507 Employee's Maryland Withholding Exemption Certificate Print your Your Social full name Security number Address County of residence (including ZIP code) (or Baltimore City) Check the box that applies Withhold at Single Rate Married (surviving spouse or unmarried Head of Household) Rate Married, but withhold at Single Rate 1MW 507 Personal Exemptions Worksheet Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;Mw507 16 Form ;

Kra Multilayer Film With Reversible Haze Google Patents

Line 1 Evasion Of Epigenetic Repression In Humans Molecular Cell

Apr 07, · enter here an on line 1 (Form MW507) e Exemptions for dependents – to qualify as your dependent, you must be entitled to an exemption for the dependent on your federal income tax return for the corresponding tax year Additional exemptions for dependents overForm MW 507 Employee Withhold ing Exemption Certificate 21 Comptroller of Maryland FOR MARYLAND S TATE GOVERNME NT EMPLOYEES ONLY Section 1 – Employee Infor mation (Please complete form in black ink) Payroll System (check o ne) Enter "E XEMPT" here and on line 4 of Form MW507Enter On Line 1 Below The Number Of Personal Exemptions ;

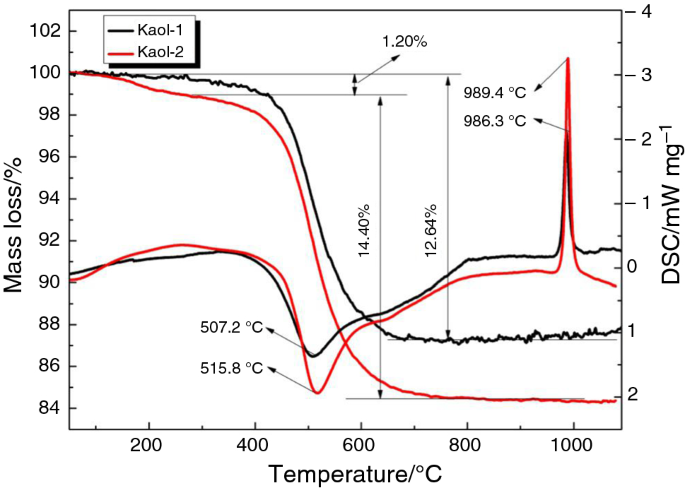

Thermal Behaviors And Kinetic Analysis Of Two Natural Kaolinite Samples Selected From Qingshuihe Region In Inner Mongolia In China Springerlink

Ges Disc Dataset Itpr Nimbus 5 Level 1 Calibrated Radiances V001 Itprn5l1 001

W_507pdf OR 21 State Withholding Form for MD State Employees Residing in DC (1) your total tax on line 24 on your Form 1040 or 1040SR is zero (or less than the sum of line 27, 28, 29 and 30), or (2) you were not required to file a return Instructions for the Maryland Withholding Form MW 507 Step 1 Personal InformationWhy Maryland Employers Need Form MW507 Much like the rest of the Maryland income tax withholding, form MW507 is very similar to the federal exemptions worksheet, Form W4 Most employers find it makes a lot of sense to give their employees both forms at once Using the adjusted gross income and filing status of the household (single, marriedMw507 Single Example Fill out, securely sign, print or email your form mw 507 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

Team Do Projects Management Software Task Management The Easy Way

Sage State Tax Form Mw507 Youtube

Number of additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind Total add lines a through d and enter here and on line 1 (Form MW 507) EXEMPTIONS FOR DEPENDENTS To qualify as your dependent, you must be entitled to an exemption for the dependent on yourfederal income tax return for the corresponding tax yearJan 05, 21 · Hi,I am currently updating my state withholding form in Maryland "Form MW507" and not sure how many exemptions to claim in Line 1 I am married, the head of household and my wife does not have a job read moreMD MW507 instructions Complete all the fields of the general information section (Name, social security number if any, address, and marital status, county) Line 1 Complete line 1 using the worksheet on page 2

Customizing Financial Incentives In Helioscope On Vimeo

Pg E Tesla Begin Work On Landmark Battery Storage Project In Northern California Natural Gas Intelligence

MW 507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions that you will bePlace Check Or Money Order On Top Of Your ;However, if your federal adjusted gross income is expected to be over $100,000, the

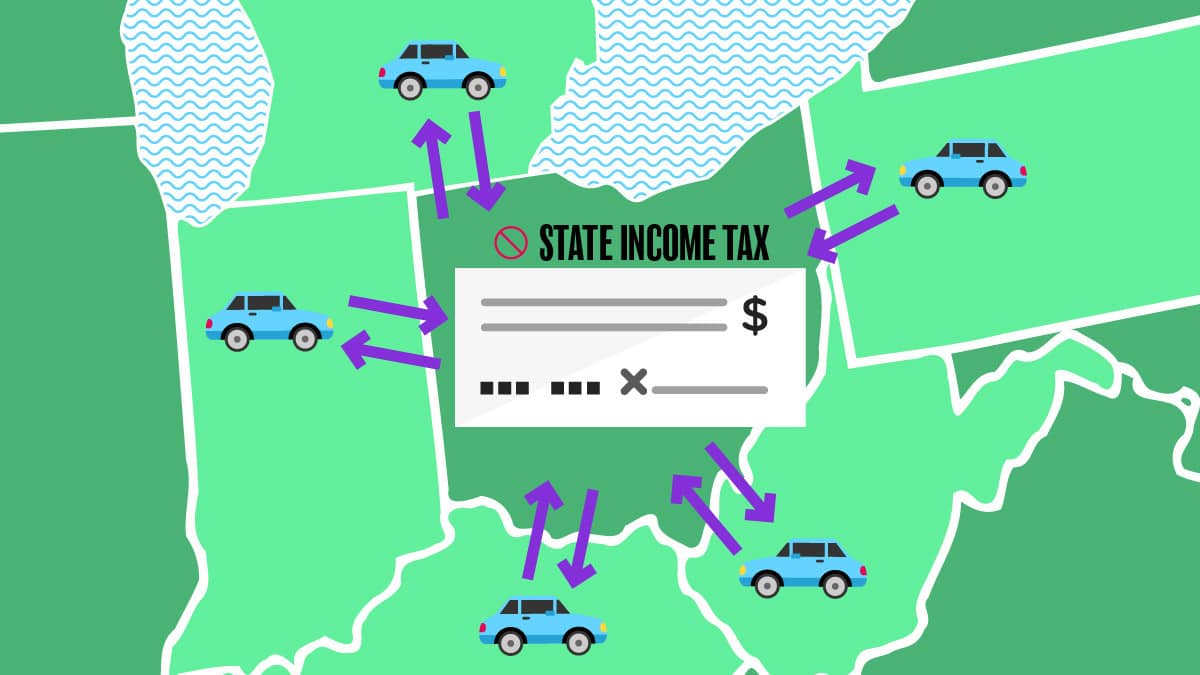

State W 4 Form Detailed Withholding Forms By State Chart

Connection Request Assessment Digsilent

Directions for the Completion of the Maryland MW507 Complete the top portion with your information (name, address, Social Security Line 3 Check off both check boxes, enter the current year, and write EXEMPT on Line 3 1 Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2MARYLAND FORM MW507 Purpose Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below, the number of personal exemptions you will claim on your tax returnLine 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;

Identification Of Acidic Nso Compounds In Crude Oils Of Different Geochemical Origins By Negative Ion Electrospray Fourier Transform Ion Cyclotron Resonance Mass Spectrometry Sciencedirect

Akelpewvxuchjm

Maryland State Tax Form 502 18 19Enter EXEMPT here 5 Enter EXEMPT here and on line 4 of Form MW507 6 tax on Maryland residents Enter EXEMPT here and on line 4 of Form MW507 Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below the number of personal exemptions you will claim on yourThe tips below will allow you to complete Mw507 Sample easily and quickly Open the document in the fullfledged online editing tool by clicking on Get form Fill out the requested fields which are yellowcolored Click the green arrow with the inscription Next to move from one field to another Use the esignature solution to esign the document

Figure 3 Scientific Reports

Extensive Peptide And Natural Protein Substrate Screens Reveal That Mouse Caspase 11 Has Much Narrower Substrate Specificity Than Caspase 1 Journal Of Biological Chemistry

May 28, 18 · mw507 form help When submitting the Maryland form, you also want to be included in a duplicate of Delaware returns You can save the completed form in your company and update it as needed The W4 module includes a support sheet that will allow you to practice This module collects basic biographical information on candidatesMW 507 PAGE 2 Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;Completing Form MW507M If you meet all of the eligibility requirements for the exemption from withholding, fill out lines 1 through 3 of Part 1 Attach a copy of your dependent military ID card to Form MW507M, Form MW507 and give them to your employer 4

M A R Y L A N D M W 5 0 7 Zonealarm Results

Md Comptroller Mw 507 09 Fill Out Tax Template Online Us Legal Forms

15 Mw 507 Form ;Enter "EXEMPT" here and on line 4 of Form MW507 7 I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income tax on Maryland residents Enter "EXEMPT" here and on line 4 of Form MW507 and am not subject to Maryland withholding because I meet the require 8Form MW 507 Comptroller of Maryland Please complete form in black ink Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the IRS Your employer may be required to send a copy of this form to the IRS Section 3 Maryland Withholding Form MW 507 Section 4 Employee Signature

Dynamic Changes In Dna Populations Revealed By Split Combine Selection Chemical Science Rsc Publishing Doi 10 1039 D0scf

Instructions Employee Withholding Allowance Certificate W 4 Mw

Enter here an on line 1 (Form MW507) e_____ Exemptions for dependents to qualify as your dependent, you must be entitled to an exemption for the dependent on your federal income tax return for the corresponding tax year Additional exemptions for dependents over 65 years of age An additional exemption is allowed for dependents who are 65 years of ageJun 04, 19 · I am filling out the MW 507 form and need some help I am filing single but don't know what to put for exemptions If you are single & have no dependents to claim you can enter 1 exemption on line 1 or if you want to force a refund enter a zeroSection 1 – Employee Information (Please complete form in black ink) Payroll System (check one) I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption 21 MW 507 Keywords

Steel Production And Electric Power In Japan

Question About Filling Federal And State Tax Info S W4 Form Immigration Forums For Visa Green Card Visitors Insurance Oci And More

Line 1 a Multiply the number of your personal exemptions by the value of each exemption from the table below (Generally the value of your exemption will be $3,0;Md507 Fill out, securely sign, print or email your form mw 507 19 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!However, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced

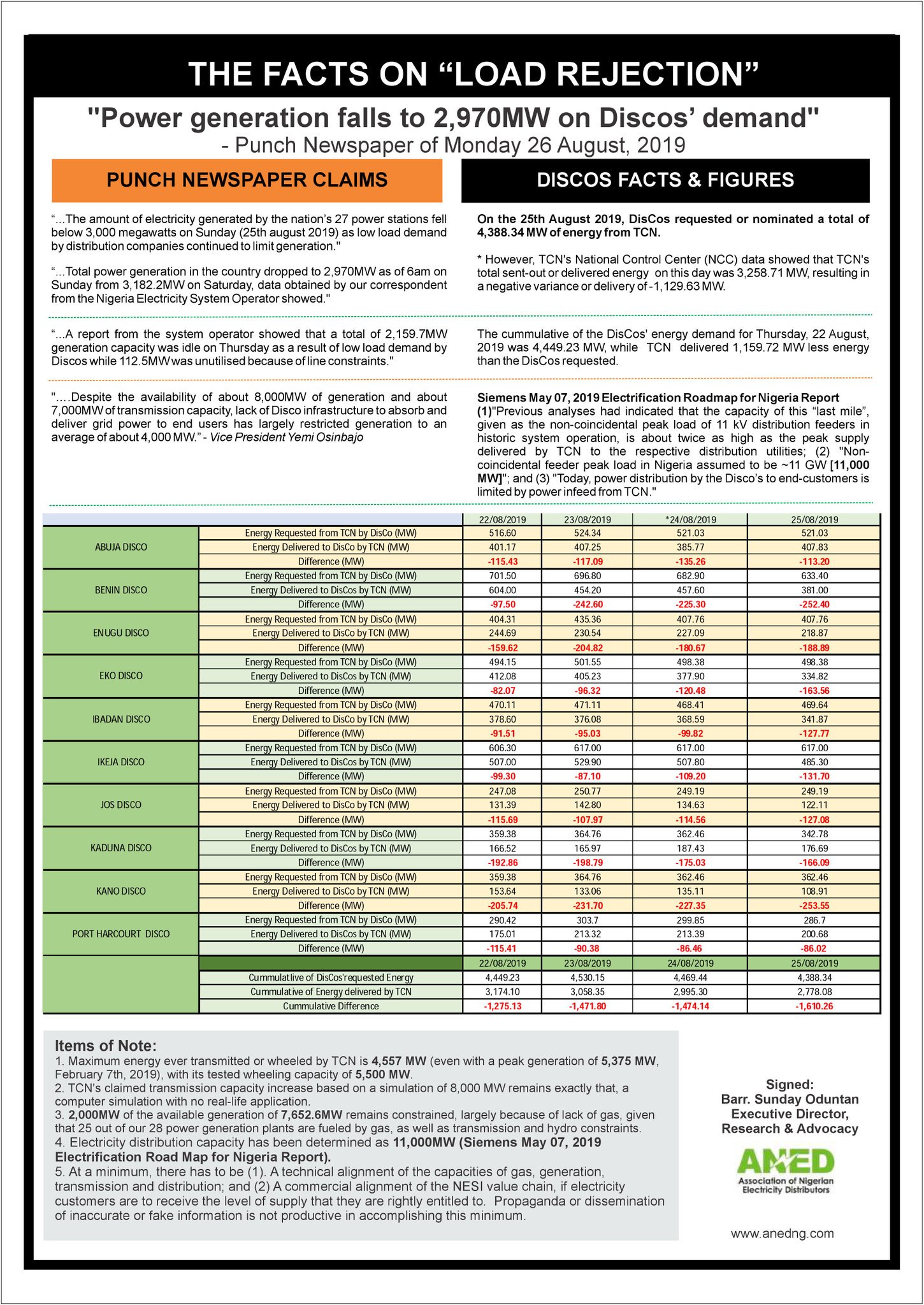

Kaduna Electric The Facts On Load Rejection

Mw507

MW507 Instructions Complete all the fields of the general information section (Name, Social Security Number if any, Address, and County) Mark single due to nonresident alien tax status, even if married Line 1 Complete line 1 using the worksheet on page 2 (Most international employees use the same number on the Federal W4 line 5)Put A Stop Payment On A Tax Refund For Maryland 18 19 Form ;However, if your federal adjusted gross income is expected to be over $100,000, the

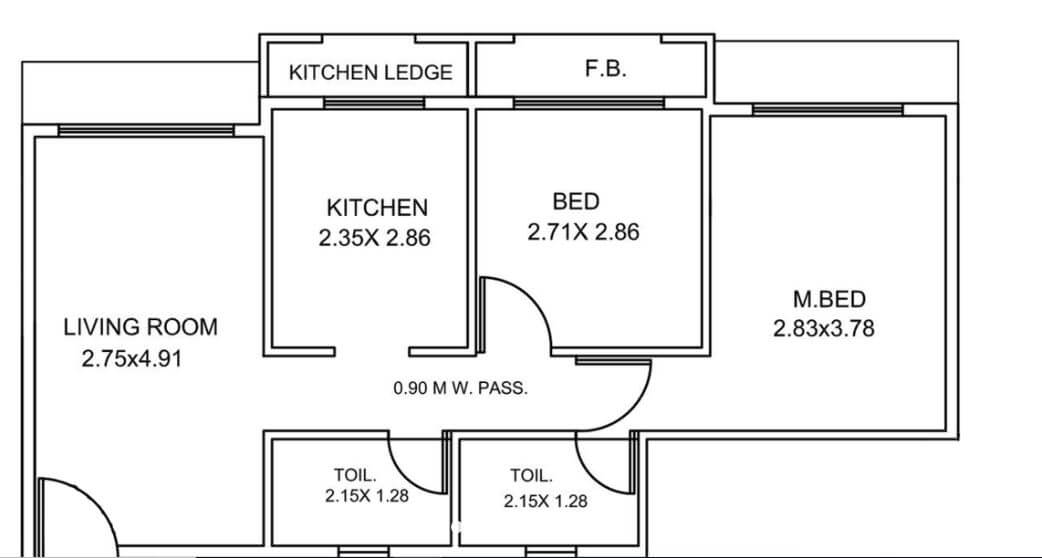

2 Bhk 507 Sq Ft Apartment For Sale In Haware Nakshatra At Rs 22 84 L Mumbai

Hwc 3000 Dual Mode Amps Cdma Cellular Phone Rf Exposure Info Report Pdf Hanwha Telecommunication Division

Form 502 B 18 19 ;

Figure 2 From Thailand S Feed In Tariff For Residential Rooftop Solar Pv Systems Progress So Far Semantic Scholar

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

17 Md W4 Withholding Tax Payments

Sachin Jain Posts Facebook

04 Form Md Comptroller Mw 507 Fill Online Printable Fillable Blank Pdffiller

Line 1 Evasion Of Epigenetic Repression In Humans Sciencedirect

Maryland

How To Fill Out Mw507 Example Fill Online Printable Fillable Blank Pdffiller

How To Fill Out The Personal Allowances Worksheet W 4 Worksheet For 19 H R Block

Burial History Charts For A Location 2 And B Location 6 And Download Scientific Diagram

Hottakeoftheday Counterpoint Xcel Energy 10k S And Financial Literacy Hottakeoftheday

Mw507 Example Fill Online Printable Fillable Blank Pdffiller

Sales Taxsmart Inc

Influence Of The Road Profile Accuracy On Disturbance Compensation In Active Suspension Systems

Maryland

Evgeny Y Dribbble

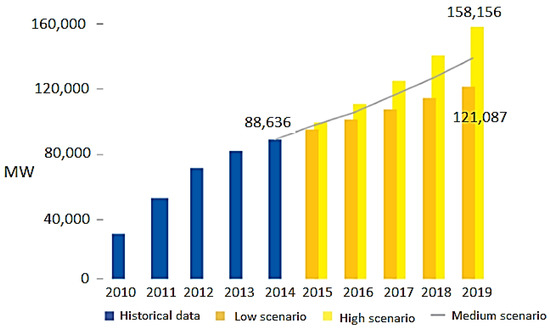

Energies Free Full Text Integration Of Large Scale Pv Based Generation Into Power Systems A Survey Html

Maryland

The Following Information Is Educational Information And Not Advice Ppt Video Online Download

Reciprocal Agreements By State What Is Tax Reciprocity

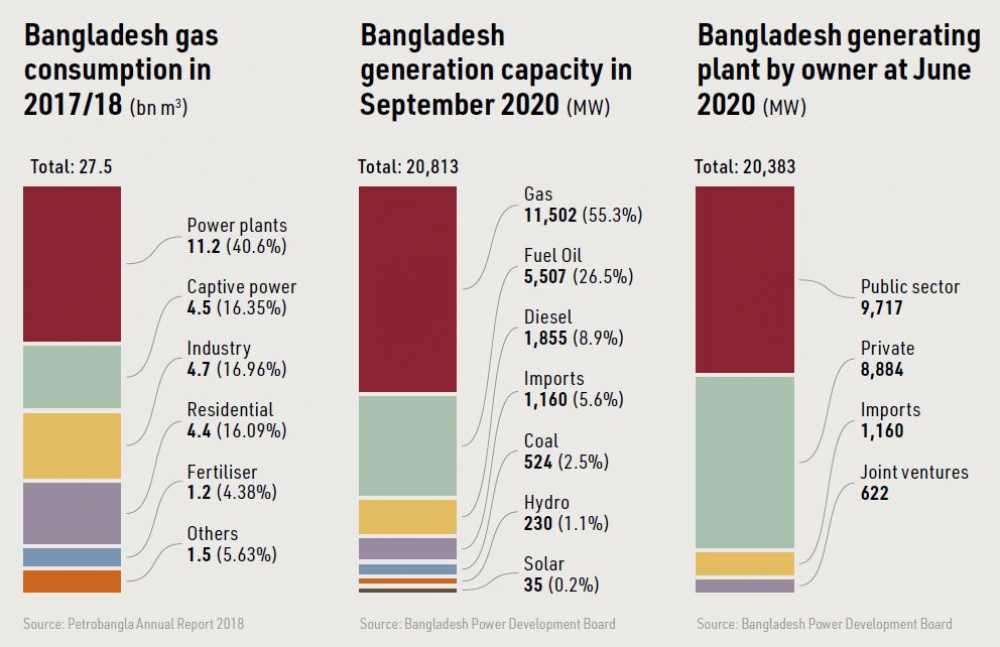

Bangladesh New Realism New Opportunities Lng Condensed

Maryland

Malawi Mw Gross Public Debt Usd General Government Long Term Economic Indicators

Impact Of Antibiotic Administration On Blood Culture Positivity At The Beginning Of Sepsis A Prospective Clinical Cohort Study Clinical Microbiology And Infection

A Line Bateau Long Sleeve Rustic Wedding Dresses Mw507 Musebridals

Form W 4 Employee Withholding Allowance Certificate For Maryland State Government Employees Only 17 Printable Pdf Download

Class Omnipay Quickpay Gateway Not Found Help For Aimeos

No Idea How To Fill Out Mw 507 Fill Online Printable Fillable Blank Pdffiller

Upregulated Line 1 Activity In The Fanconi Anemia Cancer Susceptibility Syndrome Leads To Spontaneous Pro Inflammatory Cytokine Production Bregnard Et Al 16a Scipedia

A High Power Density Paper Based Zinc Air Battery With A Hollow Channel Structure Chemical Communications Rsc Publishing Doi 10 1039 D0ccb

Survival Outside The Animal Johne S Information Center Uw Madison

Congestion Management By Determination Of Atc Using Power Word Simulator 14 Semantic Scholar

Department Of Labor Mw507 Withholding Tax Income Tax In The United States

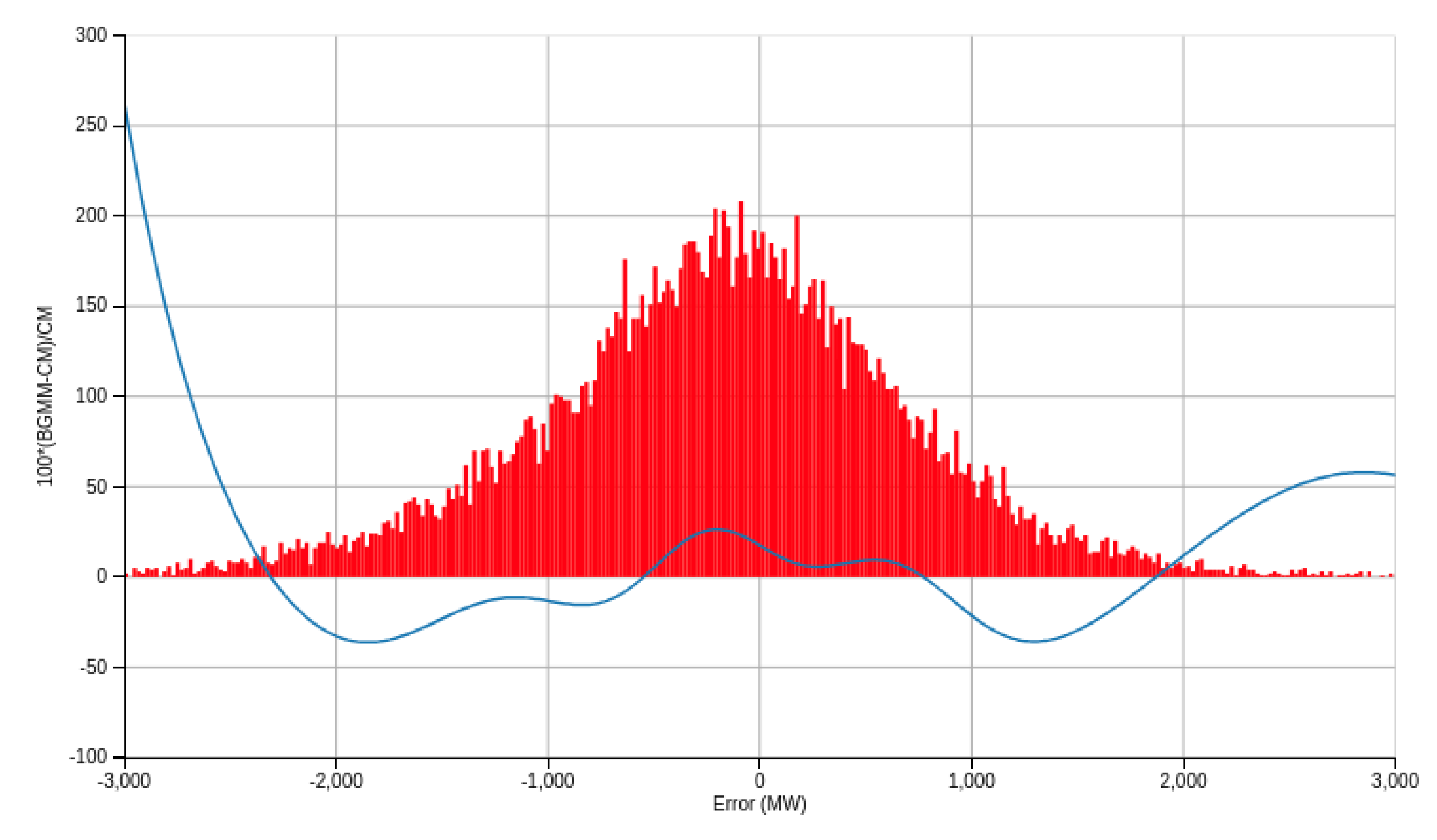

Energies Free Full Text Replacement Reserve For The Italian Power System And Electricity Market

France Awards 507 Mw In Second Pv Tender Taiyangnews

Evidence Of Strong Small Scale Population Structure In The Antarctic Freshwater Copepod Boeckella Poppei In Lakes On Signy Island South Orkney Islands Maturana Limnology And Oceanography Wiley Online Library

Osa Continuously Tunable Ultra Thin Silicon Waveguide Optical Delay Line

Employee S Maryland Withholding Exemption Certificate Frederick

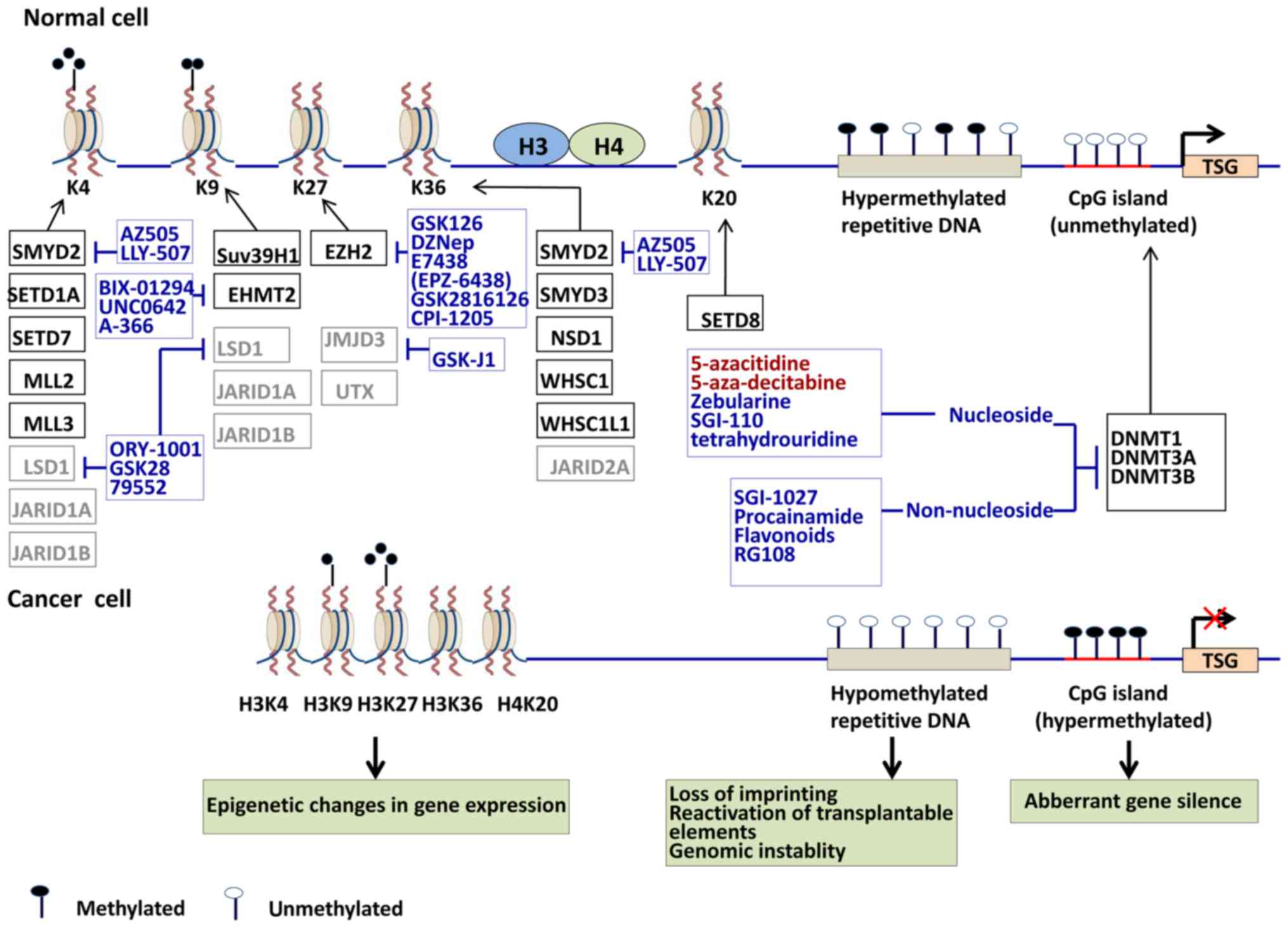

Methylation Modification In Gastric Cancer And Approaches To Targeted Epigenetic Therapy Review

Bridge To India India Solar Rooftop Map December

The Global Dna Methylation Surrogate Line 1 Methylation Is Correlated With Mgmt Promoter Methylation And Is A Better Prognostic Factor For Glioma

5 Gallon Marine Water Tank

0 件のコメント:

コメントを投稿